Cryptocurrency Candlesticks: Understanding the Basics The world of cryptocurrency trading can be complex and intimidating, especially for beginners. One key aspect of analyzing price movements in the crypto market is through the use of candlestick charts. In this article, we will delve into the basics of cryptocurrency candlesticks, explaining what they are, how to read them, and why they are important for traders.

Cryptocurrency Candlesticks: Understanding the Basics The world of cryptocurrency trading can be complex and intimidating, especially for beginners. One key aspect of analyzing price movements in the crypto market is through the use of candlestick charts. In this article, we will delve into the basics of cryptocurrency candlesticks, explaining what they are, how to read them, and why they are important for traders.

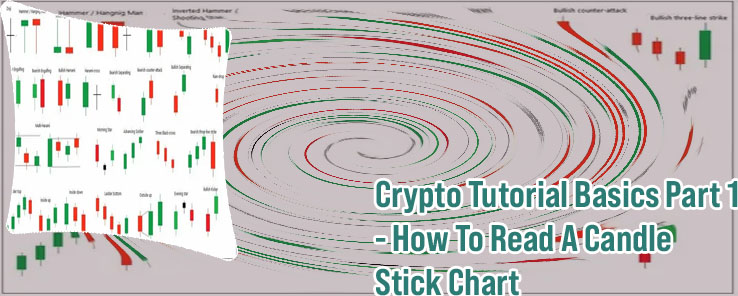

The Ultimate Guide to Crypto Candlestick Patterns

Cryptocurrency trading can be a complex and volatile endeavor, but understanding candlestick patterns can give traders a significant edge in predicting market movements. This comprehensive guide delves into the world of crypto candlestick patterns, providing valuable insights for both novice and experienced traders.

One of the key benefits of mastering candlestick patterns is the ability to identify trend reversals and continuations. By recognizing patterns such as the bullish engulfing pattern or the evening star pattern, traders can make informed decisions on when to enter or exit trades. Additionally, understanding candlestick patterns can help traders interpret market sentiment and make more accurate predictions about future price movements.

The guide covers a wide range of candlestick patterns, from simple single-candle patterns to complex multi-candle patterns. Each pattern is accompanied by clear explanations and visual examples, making it easy for traders to learn and apply their newfound knowledge. Whether you're looking to improve your trading skills or simply expand your knowledge of technical analysis, this guide is an invaluable resource for anyone interested in cryptocurrency trading.

Key points covered in the guide:

- Introduction to candlestick patterns and their significance in cryptocurrency trading.

- Explanation of common single-candle patterns such as doji, hammer, and shooting star.

- In-depth analysis of multi-candle patterns like the

How to Use Crypto Candlesticks for Profitable Trading

Crypto candlesticks are an essential tool for traders looking to make profitable decisions in the volatile world of cryptocurrency. This comprehensive guide provides valuable insights into understanding and utilizing candlestick charts effectively. By analyzing patterns and trends displayed by these candlesticks, traders can gain a better understanding of market sentiment and make informed trading decisions.

One practical use case of utilizing crypto candlesticks is identifying trend reversals. By carefully studying the patterns formed by candlesticks, traders can pinpoint potential trend reversals and adjust their trading strategies accordingly. For example, a trader may notice a series of bullish candlesticks followed by a bearish engulfing pattern, signaling a potential trend reversal. By recognizing this pattern early on, the trader can make the necessary adjustments to their positions and capitalize on the changing market conditions.

Overall, "How to Use Crypto Candlesticks for Profitable Trading" offers valuable insights and practical tips for traders looking to improve their trading skills. By mastering the art of reading and interpreting candlestick charts, traders can enhance their profitability and make more informed decisions in the fast-paced world of cryptocurrency trading.