Bitcoin has become a popular investment option for many individuals seeking to capitalize on the cryptocurrency market. As the price of Bitcoin can be quite volatile, it is essential to understand how it has fluctuated over time to make informed investment decisions. The following articles provide valuable insights into the historical price trends of Bitcoin, helping investors gain a deeper understanding of its price movements.

Bitcoin has become a popular investment option for many individuals seeking to capitalize on the cryptocurrency market. As the price of Bitcoin can be quite volatile, it is essential to understand how it has fluctuated over time to make informed investment decisions. The following articles provide valuable insights into the historical price trends of Bitcoin, helping investors gain a deeper understanding of its price movements.

Exploring the Historical Price Trends of Bitcoin

Bitcoin, the pioneer of cryptocurrency, has been a subject of fascination for many investors and traders due to its volatile nature. Understanding the historical price trends of Bitcoin is crucial for anyone looking to invest in this digital asset.

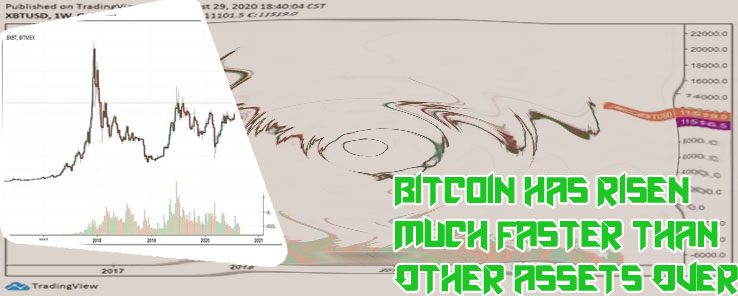

Over the past decade, Bitcoin has experienced significant price fluctuations, with dramatic highs and lows. By exploring the historical price trends of Bitcoin, investors can gain valuable insights into the factors influencing its price movements. From the initial price of less than a cent in 2010 to its peak of nearly $65,000 in 2021, Bitcoin's price history is a rollercoaster ride that has captured the attention of the financial world.

One key aspect to consider when analyzing the historical price trends of Bitcoin is the impact of market sentiment. Sentiment analysis can help investors understand the emotional factors driving price movements, such as fear, greed, and market hype. Additionally, technical analysis tools like moving averages and support/resistance levels can provide valuable information on potential price trends.

In conclusion, exploring the historical price trends of Bitcoin can provide valuable insights for investors looking to navigate the cryptocurrency market. By understanding the factors influencing Bitcoin's price movements, investors can make informed decisions and potentially capitalize on the volatility of this digital asset.

Analyzing the Factors Influencing Bitcoin's Price Fluctuations

Bitcoin's price fluctuations have been a topic of great interest and speculation in the financial world. Understanding the factors that influence these fluctuations is crucial for investors and traders looking to make informed decisions in the volatile cryptocurrency market.

One key factor that influences Bitcoin's price is market demand. Like any other asset, Bitcoin's price is determined by the balance between supply and demand. When demand for Bitcoin is high, its price tends to rise, and vice versa. Factors such as media coverage, regulatory developments, and macroeconomic trends can all impact demand for Bitcoin.

Another important factor is investor sentiment. The price of Bitcoin is also influenced by how investors perceive its value and future potential. Positive news, such as the adoption of Bitcoin by major companies or the launch of new financial products, can drive up prices as investors become more optimistic about Bitcoin's prospects.

Technical factors, such as trading volume and market liquidity, also play a role in Bitcoin's price fluctuations. High trading volumes and liquidity can lead to more price volatility, while low volumes may result in more stable prices.

In order to better understand and predict Bitcoin's price fluctuations, it is important to consider factors such as market demand, investor sentiment, and technical indicators. By keeping an eye on these key factors, investors can make more informed decisions in

Strategies for Predicting Bitcoin Price Movements

Bitcoin, the world's first decentralized cryptocurrency, has been making headlines with its meteoric rise in value over the past few years. As a result, many investors are looking for strategies to predict Bitcoin price movements in order to capitalize on this digital gold rush.

One common strategy used by traders is technical analysis, which involves studying past market data such as price charts and trading volumes to identify patterns that can help predict future price movements. By analyzing trends and using indicators such as moving averages and Fibonacci retracements, traders can make more informed decisions about when to buy or sell Bitcoin.

Another popular strategy is fundamental analysis, which involves evaluating the underlying factors that can affect the price of Bitcoin. This can include factors such as regulatory developments, market sentiment, and macroeconomic trends. By staying informed about news and events that can impact the cryptocurrency market, traders can gain a better understanding of the forces driving Bitcoin's price movements.

In addition to technical and fundamental analysis, some traders also use sentiment analysis to gauge market sentiment and predict Bitcoin price movements. By monitoring social media platforms, forums, and news outlets for mentions of Bitcoin, traders can get a sense of how the market is feeling and make decisions accordingly.